An outlier or anomaly is typically defined as a case that is markedly distant or different from the bulk of the data. Our July 28 blog on outliers and anomaly detection reported on one unusual case in which the outlier might lie fully within the typical data range.

“In one aerospace project, for example, the relevant variables for projecting trajectories included velocity, angle of attack, altitude, yaw, pitch. and roll. It is entirely possible for there to be numerous infeasible or anomalous combinations with individual values that lie within the range for each variable. For example, a trajectory could have within-range yaw (feasible when taken by itself) at one point, and within-range roll (feasible when taken by itself) at another, yet the combination of the two might be aerodynamically impossible.”

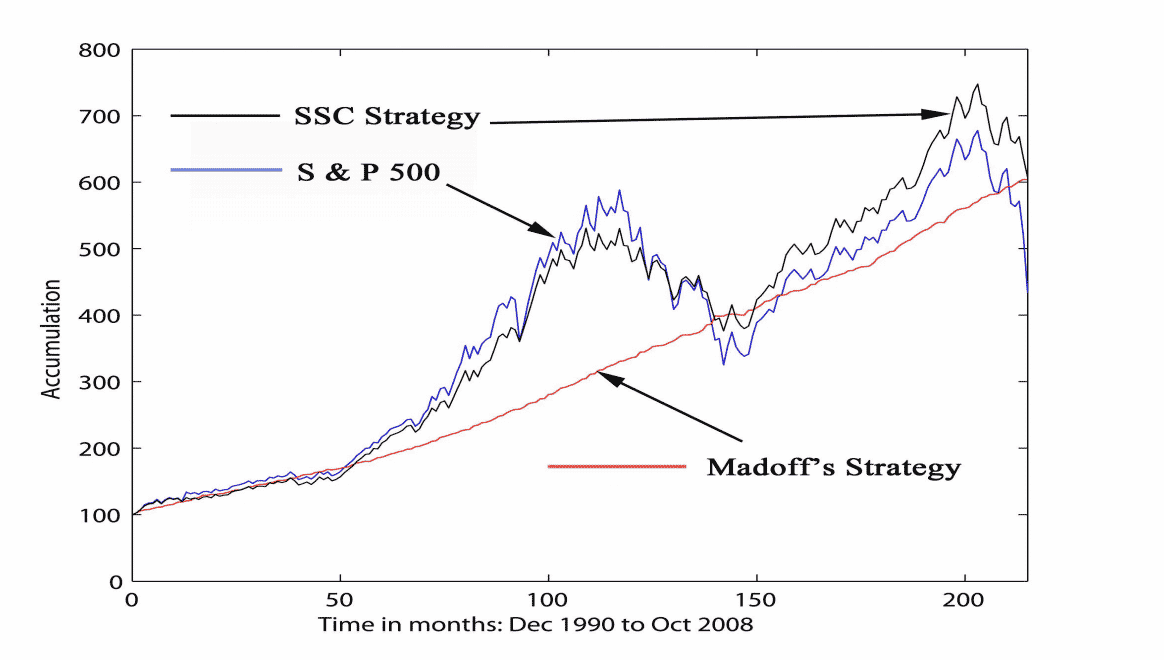

Since then, another famous example of an “outlier in the middle” has been brought to my attention: the Bernie Madoff case. The Madoff fund’s notably consistent positive returns (red line) stood in stark contrast to the S&P market index (blue). Madoff’s returns are well within the range of those of the broader market, what made them an outlier was their lack of volatility. It was this anomalous consistency (continuous positive returns) that helped bring him to the attention of investigators, who eventually uncovered the pyramid scheme that underlay the Madoff fund.

Figure: Madoff returns (red) contrasted with the S&P 500 (blue). Researchers also plotted a reconstruction of what Madoff said he was doing (an options-based “split strike conversion” strategy) (source)